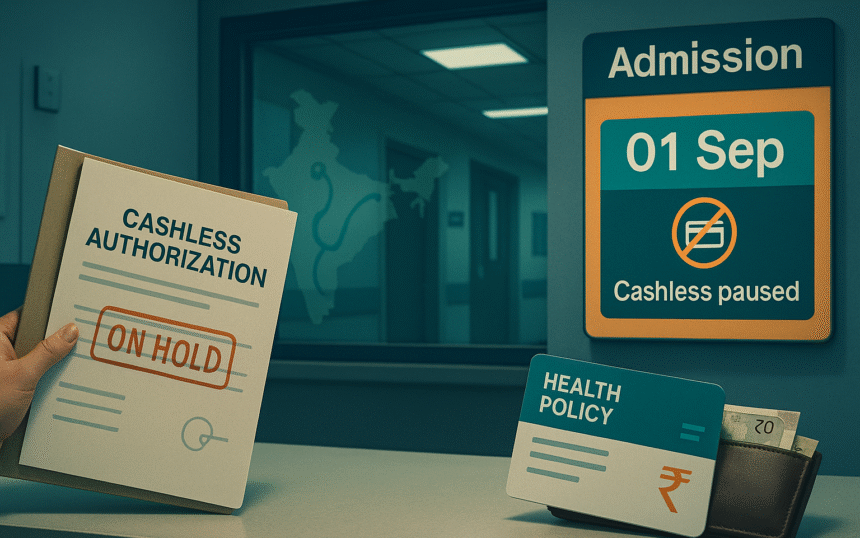

The Association of Healthcare Providers India has advised member hospitals in North India to suspend cashless treatment for Bajaj Allianz General Insurance policyholders from September 1. A similar notice was sent to Care Health Insurance, with AHPI seeking a response by August 31. Senior leaders of Bajaj Allianz and AHPI are meeting today, and Bajaj Allianz has a follow up meeting with the General Insurance Council on September 2.

What the advisory means

If the advisory holds, patients covered by Bajaj Allianz in the affected hospitals would need to pay at the counter and file for reimbursement later, rather than use pre authorization for direct insurer to hospital payment. AHPI says the step flows from disputes over reimbursement rates and legacy tariff packages. Insurers have pushed back through their industry body, calling the move disruptive and urging withdrawal.

Who is covered and where

AHPI represents a large network of private hospitals, including major chains in North India. Its communication named Bajaj Allianz and also mentioned Care Health in a separate notice. Care Health said it was surprised by the reference and sought clarity. Regional AHPI units have tried to calm nerves, with some states indicating no change for other insurers while talks continue.

Positions of the two sides

AHPI has accused the insurers’ body of using anti competitive tactics that push down hospital tariffs, citing a proposed common empanelment drive and rate pressures. The General Insurance Council has termed the step arbitrary and lacking clarity. Both sides say patient access should not suffer, yet neither has publicly confirmed a negotiated rate formula.

Immediate impact on policyholders

Cashless is the dominant settlement channel by value in India. IRDAI data shows roughly two thirds of claim amounts were settled cashless in FY24. Any large scale pause can shift families to reimbursement, which strains cash flow during admission. The regulator’s annual data also shows disallowances and delays still occur, so documentation discipline becomes more important when cashless is not available.

Why this flashpoint now

Medical inflation and post pandemic procedure volumes have pushed up costs for hospitals. Insurers point to rising claim payouts and a need for tighter package pricing. Analysts and rating agencies have also flagged softer premium growth in mid 2025 as accounting transitions kick in, adding pressure to margins and making tariff negotiations more contentious.

Premium trends set the backdrop

Health is the largest slice of non life premiums in India. Sector sources put the share near 40 to 41 percent. Insurers have been seeking higher retail health premiums in 2025, citing claim trends and medical costs. City specific hikes have also been discussed earlier this year. These forces heighten friction when hospitals ask for higher rates on cashless packages.

What hospitals say

Hospital representatives argue that tariffs agreed years ago no longer reflect costs in areas like oncology, cardiac care, and robotics assisted surgery. AHPI’s public statements call for updates to reimbursement schedules and for an end to post authorization deductions, which hospitals say create working capital stress.

What insurers say

Insurers maintain that blanket hikes would raise premiums further and that standardization through a common empanelment process improves transparency. The General Insurance Council has urged AHPI to withdraw the advisory and continue cashless services while negotiations proceed.

What to watch next

- Outcome of today’s AHPI and Bajaj Allianz meeting, and the September 2 discussion with the General Insurance Council.

- Whether AHPI modifies, suspends, or widens the advisory after responses from the two insurers.

- Any regulatory or competition authority escalation if rate talks stall.

Bottom line for families and employers right now

Carry physical and digital copies of policy cards, KYC ID, and previous treatment records to admission. Confirm network status at the hospital desk before planned procedures. If told cashless is unavailable for your policy, ask for the written reason and get the pre authorization submitted while you decide on deposit and room category. This is prudent until the meetings conclude and formal updates are issued.