I know those little checkboxes at car insurance renewal can feel like a money trap. Add ons often look optional. Until life throws waterlogging, a nasty repair bill, or a midnight breakdown at you. Then they stop being optional and start looking like relief.

When it comes to car insurance, add ons are small payments that protect big savings. They turn chaos into control. That is what I want for you.

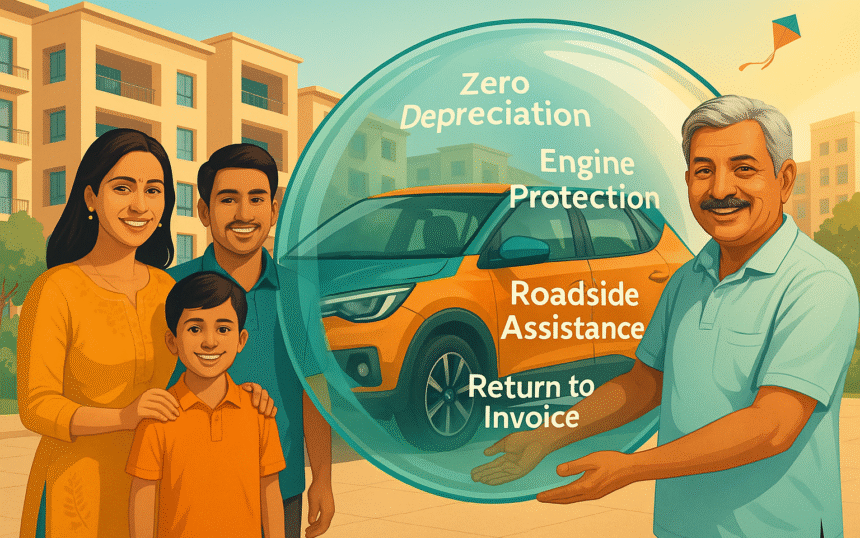

What an Add On really does

- Zero Depreciation

Parts lose value every year. Without this, you pay that loss during claims. With it, the deduction is avoided on eligible parts. On a single repair, the saving can be many times the add on price. - Engine Protection

Water and engine do not get along. Monsoon and underbody hits are costly. This cover can save you from a heart stopping bill. - Roadside Assistance

A flat tyre near Chandkheda at midnight is not a story you want. One call brings help. Towing, jump start, fuel delivery, on the spot fixes. - Return to Invoice

For theft or total loss, you get back to the original invoice value. Not the reduced market value. - NCB Protection, Key Replacement, Personal Belongings

These are small comforts that matter on a bad day. Keep your bonus safe. Replace a lost smart key. Recover stolen items kept in the car as per terms.

A simple view of value

| Add On | Typical cost band | When it feels like magic |

|---|---|---|

| Zero Depreciation | Low to moderate yearly top up | Panel and parts replacement after an accident |

| Engine Protection | Low yearly top up | Water damage or engine failure after waterlogging |

| Roadside Assistance | Very low yearly top up | Stranded on highway or late night breakdown |

| Return to Invoice | Moderate yearly top up | Theft or total loss of a newer car |

| NCB Protection | Very low yearly top up | Small claim without losing next year discount |

Choosing the Right Add-Ons for Your Situation

You deserve the best car insurance, one that suits your life, not a random shopping list of extras. Let’s balance your needs and budget in practical terms.

What Comes Standard

Most insurers only include third-party or basic comprehensive coverage by default. That means depreciation, engine mishaps and breakdown help often come with your cash—not your policy. Experts confirm simply skipping add-ons can cut your claim by up to 25% when parts depreciate.

No two roads are the same. Your coverage should reflect your journey. Let’s match the right add-ons to where you live, drive, and budget.

What Add-On Works for Your Situation?

1. Engine Protection Cover – When Every Raindrop Matters

If you live in flood‑prone Ahmedabad streets or drive through waterlogged zones, hydrostatic lock is a lurking cost. The engine protection add-on shields you from those shocks. Typical premium? Around ₹1,500 to ₹3,000 per year, or roughly 5–10% of your own-damage premium. In other words, a small amount today to avoid a six‑figure surprise tomorrow.

2. Roadside Assistance – For Late-Night Drives & Highway Runs

Stuck on a highway with a flat tyre or dead battery? Roadside Assistance add-on gets you help, not a headache. InsuranceDekho and PolicyBazaar both confirm flat tyre fixes, towing, fuel delivery, even jump starts are typically covered.

Acko labels it a “good addition” for long drives. The cost can be as low as a few rupees per day, starting at ₹6/day, making it a small premium for big peace of mind.

3. Return to Invoice – Protect Your Car’s True Value

For cars that are newer or hold sentimental value, this add-on ensures you get the invoice value, not the depreciated one, in a total loss or theft. It may cost extra, but it’s the emotional buffer many of us appreciate owning.

Reddit Indian car owners highlight this too, how some policies now even offer current-year ex-showroom rates. If you’d want to replace your loved ride tomorrow at today’s price, this is your friend.

4. Zero Depreciation – When Every Part Counts

If your car is under 5 years old, depreciation can eat into your claim amount, especially on small parts. PolicyBazaar explains: with zero dep, you get full replacement cost; without it, depreciation chips away at your claim.

Think of it as paying once, avoiding many small losses down the line.

How to Match Add-Ons to Your Reality

- New or High-Value Car?

Zero Depreciation adds peace of mind. It keeps depreciation deductions off your final claim. Fact is, with a ₹10‑lakh car, add-on cost of ₹7k–12k can save ₹40k or more on repairs. - Territory Prone to Washouts or Flooding?

Engine is a high-ticket repair. Engine Protection add-on saves from thrust faults and water ingression. Especially relevant for older cars in monsoon-inundated areas. - Late-Night Drives or Highway Routes?

Roadside Assistance isn’t just a premium, it’s calm in a crisis. For a few hundred rupees, you get help with flat tires, towing, and fuel delivery. - Car in Garage Long-Term?

Daily Allowance keeps your life in motion while repairs get done. Often, you get ₹500 a day for up to two weeks . - Worried about Losing Your Price After Total Loss or Theft?

Return to Invoice cover protects your full invoice value, till about 3–5 years of age. It’s a guaranteed buffer beyond IDV.

Add-Ons Worth Ignoring (For Some)

- Zero Depreciation on Older Cars – It may not even be available three years in. And if it is, it may not pay off.

- Overlapping Covers – If you already have personal belongings or NCB protection through other plans, you may not need add-ons specific to those, unless they bring unique benefits.

- Multiple Add-ons with Tight Budget – Start with the must-haves for your situation. Add as needed later.

How They Stack Cost vs. Peace of Mind

| Situation | Best Addons |

|---|---|

| New or luxury car | Zero Depreciation, RTI |

| Monsoon, flood-prone zones | Engine Protection |

| Night/highway travel | Roadside Assistance |

| Garages for days post-accident | Daily Allowance |

| Theft or total loss risk | Return to Invoice |

| Older car with tight budget | Stick with essential comprehensive only |

Why These Choices Matter

Each add-on isn’t extra, hey are shields for the unexpected. If I had to pick just one for a monsoon-struck neighbourhood like ours, it’d be Engine Protection. If I travel into the night, Roadside Assistance becomes non-negotiable.

These choices aren’t about splurge; they are about choosing wisely, with your surroundings, your ride, and your future in mind.

Real Numbers, Real Value: Are Add-Ons Worth It?

Let’s break it down, real costs vs. real savings. When weather or breakdowns strike, the right add-on can be the difference between calm and crisis.

Monsoon Claims Are Climbing

During last monsoon, repair bills jumped 33%, from ₹30,000 to ₹40,000. Yet most drivers skip add-ons like engine protection. Without it, you may carry a heavy bill alone.

True Cost vs Real Benefit

Here’s how the numbers stack up for a ₹5 lakh car:

- Zero Depreciation costs ₹3,000–₹5,000, yet can save you ₹25,000 on a ₹50,000 repair.

- Engine Protection costs ₹500–₹3,000 and shields you from potential engine repairs of ₹1.5 lakh or more.

- Roadside Assistance is about ₹200–₹500, offering help and preventing delays—not counting as a claim, so your NCB stays safe.

Average ranges as below:

| Add-On | Approximate Cost |

|---|---|

| Zero Depreciation | ₹1,000–₹3,500 |

| Engine Protection | ₹500–₹1,200 |

| Roadside Assistance | ₹150–₹500 |

| NCB Protection | ₹400–₹800 |

Market Behavior Backs It Up

During recent monsoons, Indian drivers opted for following addons with their car insurance:

- 60% chose Roadside Assistance

- 55% chose Zero Depreciation

- 20% opted for Engine Protection and Return-to-Invoice

That tells a story, people are learning the value of resilience.

Sharmaji’s Quick Math and Truth

Add-on cost: ₹2,000–₹5,000. Potential savings: ₹25,000–₹150,000. That’s not spending, it’s added security.

If monsoon waters creep in, or late-night trouble finds you, these little checkboxes add clarity, not chaos. A small choice today can spare big worry tomorrow.

Call Sharmaji today to discover the right coverage for your car.