Last week an Ahmedabad family showed me their renewal. Same policy, higher premium, and a new word that confused them, riders. If you feel the same, breathe. Health insurance riders in India are not a trick, they are tools.

Medical costs keep rising. Base policies try to cover most things, but real life is messy. Diabetes before policy start. A baby on the way. A surgery that exhausts the sum insured. These gaps are where a good rider can save the day.

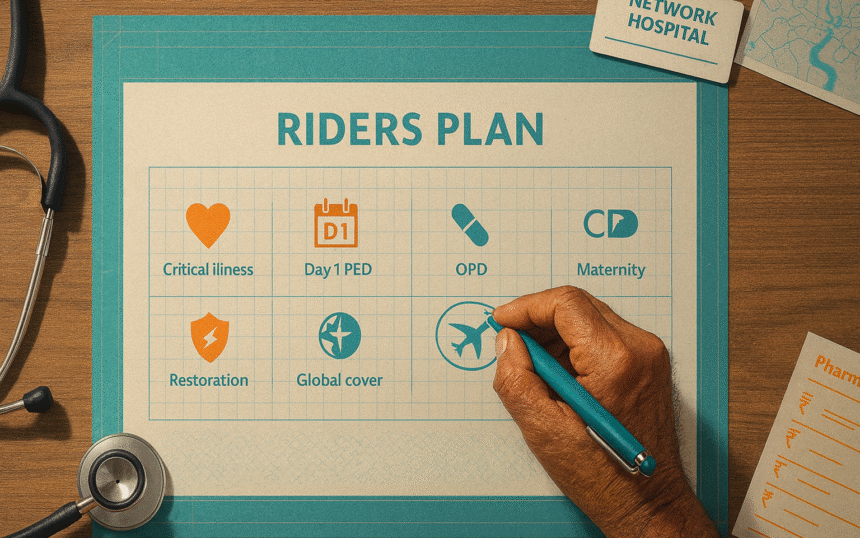

Think of your health insurance policy like a solid home in the monsoon. The roof is strong, but some windows need grills. A rider is that simple add on. You pay a small extra amount to cover a specific risk, like critical illness, OPD visits, maternity, or restoring the sum insured after a big claim.

The goal is not to buy everything. The goal is the sahi fit. If your parent has long term sugar, a Day 1 PED rider can remove waiting worries. If you are planning a child, a maternity rider can protect the budget, but it often has a waiting period. If hospital bills drained your cover once, restoration can refill it within the year.

I will keep this simple, Indian, and practical. We will choose only what adds real value, and skip what looks shiny but does not help your family.

Come, let us first understand how riders actually work so choices feel easy.

How Health Insurance riders work

When you buy health insurance, you pick a base plan first. Then you can add small attachments for special needs. Those are riders. Insurers also call them add ons. They sit on top of your policy and change what it covers or how much it pays.

Some riders pay a fixed lump sum for a listed event. That is a benefit type payout. Think critical illness. Some simply expand hospital cover. That is indemnity. The regulator recognises both benefit and indemnity in health products, and sets broad rules for renewal and credits.

A rider has its own rules. Waiting period. Limits. What triggers the payout. These sit in the rider wording, not just the main policy. If you change hospitals or port the base policy later, the credits like waiting periods and moratorium move with you under current rules, within the product terms. Read the rider page, not only the brochure.

Where do riders fit in real life. Take OPD, for families who visit doctors often but rarely get admitted. Or restoration of sum insured, for a year with back to back hospitalisations. For pre existing diseases, some insurers now offer Day 1 PED waivers or shorter waits, but each has conditions. The master circular asks insurers to offer products and add ons that cover OPD, PED and more, across ages and conditions.

Plain meaning: a rider is an optional add on you pay for to widen or fine tune your cover.

Next, let us look at the common health insurance rider types and where they truly help.

Critical illness, maternity, OPD, global cover

A friend in Surat called me after a biopsy. The treatment was planned. The bills were bigger than the fear. A critical illness rider helped because it paid a single lump sum on diagnosis. Most plans set a 90 day wait. Many also stop the rider after one claim. Read that line in your rider wording.

Now, family planning. A maternity rider can steady the budget for delivery, checkups, and newborn care. Waiting periods vary a lot. Many plans sit between 9 months and 4 years. Some stretch longer. Buy it early if you plan a child in the next few years.

If your home clinic visits are frequent, think OPD. OPD means outpatient care, no hospital stay. A good OPD rider can cover doctor consults, diagnostic tests, and prescribed medicines. Some plans include dental or vision. Useful for kids with recurring infections or parents managing chronic issues.

Global cover sounds fancy, but check the trigger. Many policies allow planned treatment abroad only when the diagnosis or referral happens in India. Some cover only emergencies overseas, others cover both planned and emergency care. Read the clause before you rely on it.

Plain meaning: choose riders that match your real life, not a brochure wish list.

Next, we will handle pre existing disease waits and the new Day 1 options, so you know what truly removes waiting worries.

Day 1 PED and waiting periods

My uncle in Vadodara called after his renewal. He has diabetes. He asked a simple question. Will the policy help me from day one, or do I still wait.

Waiting periods exist to stop early large claims. Most base plans keep pre existing diseases on hold for up to 36 months. Many now allow shorter waits, or even day one cover, if you add a special rider and clear underwriting. Words are simple. Conditions matter.

There is also a bigger rule that sits above all this. IRDAI cut the moratorium from eight years to five. After five straight years on a policy, claims cannot be denied for past non disclosure unless it is fraud. This change protects long term policyholders across India. Keep your policy active, and renew on time.

Now the famous Day 1 PED promise. Some insurers offer riders that waive or buy back the wait. A few reduce the wait to 30 days. Others take it down to one year. Most need medical tests and higher premium. Many still exclude some planned procedures for a while. Read the rider page before you rely on a slogan.

Here is the simple way to think about it. If you already take medicines for diabetes, hypertension, asthma, or thyroid, a Day 1 rider can ease worry. It shifts cost from a future claim to a known extra premium today. If the extra premium is steep, ask the insurer for both quotes. With and without the rider. Compare in rupees, not in hope.

Plain meaning: waiting period is the time you must hold the policy before a listed condition gets covered.

Restoration of sum insured and room rent limits

A mother and son from Navrangpura met me after two hospitalisations in one year. The first stay used up most of their cover. The second came as a shock. Their plan had restoration. The cover refilled, and the second claim went through. That small add on saved their savings. Restoration means your sum insured is refilled after it is used up, once or multiple times in the same policy year, depending on the plan. Some versions even allow unlimited refills.

But there are catches. Many policies restore only after the full sum insured is exhausted, not after a small claim. Some allow restoration only for a different illness or a different family member. A few allow it for the same illness too. Read these lines with care because they decide whether a second claim is paid.

Now the famous room story. Hospital bills track your room type. If your plan caps room rent at, say, 1 percent of sum insured per day, choosing a higher room can make many line items proportionately non payable. A room rent waiver rider removes that cap so you can choose a higher room category without proportionate cuts, though the premium is higher. If your base room limit is already comfortable for your city, you may not need this rider.

How to think about these two. Restoration is useful for families and for illnesses that need staged care within one year. Room rent waiver is useful if your preferred hospital’s normal room exceeds your cap. Both are less useful if your base cover is high, and your hospitals fit within the existing room limit.

Plain meaning: restoration refills your cover after big claims, room rent waiver removes the cap on daily room cost so other charges are not cut.

What it costs: pricing principles, caps, and value checks

A Rajkot couple showed me two quotes. Same base plan, one with riders. The second looked scary until we broke it down. Rider pricing rides on your base premium. Many insurers follow a simple ceiling, the total cost of riders or add ons should not cross 30 percent of the base premium. Several mainstream explainers and insurer pages repeat this rule, so treat it as a strong thumb rule, then verify in your brochure.

What does that mean in rupees. If your family plan costs ₹18,000 a year, the combined rider price should not cross about ₹5,400. If it does, ask why. Sometimes the add on you picked is not a rider at all, it is a separate cover with its own premium. Labels vary across insurers, so read the exact wording.

Costs also depend on scope. OPD riders that pay for consults and tests can look small, but frequent use pushes premiums up at renewal. Buy them only if your family actually visits clinics often.

One more price driver is waiting periods. Shorter PED waits or Day 1 waivers usually come with higher premiums or extra conditions. Ask for two quotes, with and without the waiver, and compare the gap with your likely medical spend this year. Insurer circulars and notices from 2024 to 2025 confirm tighter rules around waits and moratorium, so long term policyholders are better protected, but you still pay more for faster access.

Plain meaning: riders should feel like smart upgrades, not a second policy hiding inside the first.

If you want, we can run your numbers together and sanity check the value.

How to choose best health insurance for your family in Gujarat

You do not need every shiny add on. You need the right two or three, matched to your reality. Here is the clean way I use with families from Ahmedabad to Surat.

- Cover the likely, not the loud, pick for your next two years of life, maternity if planning a child, Day 1 PED if a parent already takes daily medicines, restoration if your cover is modest.

- Fit riders inside your budget, cap the combined rider price near 30 percent of base premium, and drop anything you will not use twice a year.

- Read the trigger line, what exactly pays and when, for restoration check same illness rules, for room rent see proportionate deduction examples from your preferred hospital.

Plain meaning: choose by life stage, budget, and the exact sentence that decides payment.

Insurance is like a seatbelt, not a puzzle

You do not need a perfect policy. You need a policy that fits your life. Pick a steady base, add only the riders that solve real problems, and keep proof handy. When a claim comes, clarity wins.

If you feel stuck, I am here. We will look at your plan, your hospitals, and your budget. We will keep what helps, skip what does not, and write the next steps on one page.

Ready to take the first step. Talk to Sharmaji today.