Marine & Shipping Insurance in Ahmedabad & Gujarat

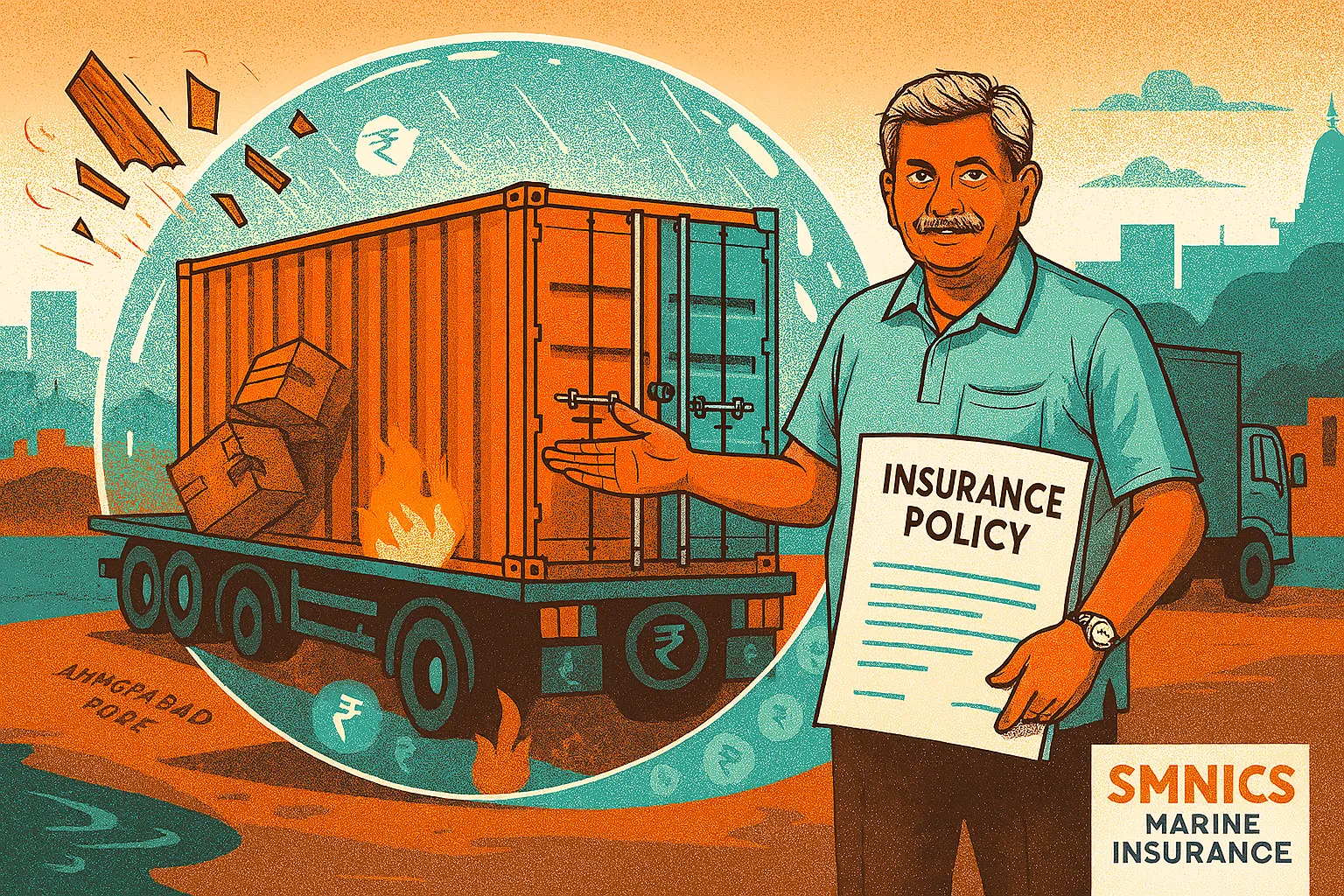

Ever seen a photo of a container ship stuck in a storm, or a lorry driver waiting at a dock, desperate for news of his missing shipment? It’s easy to think, “That’ll never happen to me.” Until it does.

Maybe you’re a textile exporter in Ahmedabad. Maybe you’re a small trader sending a valuable consignment across the Arabian Sea. Or maybe your business runs on parts arriving safely, on time, every time.

Here’s the truth: When cargo gets lost, delayed, or damaged, it’s not just the goods at stake—it’s your contracts, your cashflow, sometimes even your reputation.

That’s where I come in.

I’m Sharmaji—your partner, guide, and fighter when things go wrong on the road, rail, or sea.

I’ve spent decades helping business owners, exporters, and families recover what’s rightfully theirs after disaster strikes.

Because insurance isn’t just about a piece of paper. It’s about getting you back on your feet—fast, and with dignity.

Let’s make sure your journey never ends with regret.

Why Marine & Shipping Insurance is Essential

Ever wondered how quickly a single mishap can wipe out a year’s profits?

Cargo lost at sea. Fire in a warehouse. A truck overturned on a rainy highway. Or a customs hold-up that ruins an entire order.

Without the right marine insurance, these risks aren’t just scary—they’re business killers.

And it’s not only the big exporters. Even a small consignment—fabric, machine parts, chemicals, foodstuffs—can be worth lakhs, sometimes crores.

If something goes wrong, no transporter or shipping line will cover your losses.

The only real lifeline is insurance—and having an agent who can prove your claim.

Imagine you’ve just landed your biggest export deal. Everything is riding on this shipment. Then the container is damaged en route.

Who’s fighting for your payout?

That’s why you need marine insurance—and a partner who knows how to use it.

Who Needs Marine & Shipping Insurance?

Is this for you? If you’re any of these, the answer is YES:

- Textile or garment exporter shipping goods overseas

- Importer of machinery, spares, or raw materials

- Chemical, pharma, or foodstuff manufacturer with domestic and international shipments

- Logistics and transport companies (trucks, trailers, freight forwarders)

- Small traders sending precious consignments by rail, road, or air

- Factory owners moving capital goods or finished stock

- Anyone whose money is ever “on the move”

Even individuals shipping valuable goods for personal reasons (marriage, inheritance, gifts) can benefit from expert marine cover.

What’s Covered under Marine & Shipping Insurance (and Optional Add-ons)

SMNICS helps you get policies that protect you from every major risk, including:

- Loss or damage in transit:

Fire, theft, accident, collision, overturning, or sinking—if your goods are lost or ruined, insurance pays the value. - Marine perils:

Storms at sea, piracy, jettison, washing overboard—risks nobody thinks about until disaster hits. - Warehouse-to-warehouse cover:

Protection starts from your factory or supplier’s door, and ends at your client’s warehouse—anywhere in India or the world. - Breakage, leakage, contamination:

For fragile or liquid goods, including machinery, chemicals, electronics, and food items. - Loading and unloading risks:

Most claims happen during handling—policies can cover this critical stage. - Customs and port delays:

Optional add-on for losses due to unavoidable detention, demurrage, or pilferage at docks. - International & domestic shipments:

Single shipments or annual policies; cover via sea, air, road, or rail. - War & strike extension:

For high-risk geographies or political instability, special add-ons provide peace of mind.

Optional Add-Ons:

- High-value cargo protection (jewelry, electronics)

- Stock-throughput (continuous cover from purchase to sale)

- Freight & profit insurance (even lost profit can be covered)

- Duty insurance (for importers)

Sharmaji ensures you get all the fine print right, so you’re never left fighting over exclusions or technicalities.

Why Choose SMNICS?

40 Years of Marine Insurance Mastery

Unmatched Claims Support

Full Market Comparison

Local Roots, Global Reach

Personal Attention, Always

Transparent Advice

Track Record of Trust

Our Unique Service Process: How We Deliver Excellence

Here’s how Sharmaji handles marine and shipping insurance for you:

We meet to discuss your exact shipping needs—routes, goods, frequency, risk level, past claims. I listen first, suggest later.

We compare all top insurer offerings—no “one-size-fits-all.” You see the options, costs, and pros/cons.

We prepare every paper needed—bill of lading, invoices, packaging lists, and more. No technical terms left unexplained.

We coordinate directly with the insurer, ensure your policy covers what matters, and deliver your documents safely.

If disaster strikes, call Sharmaji first. We help file the claim, gather evidence, deal with surveyors, and fight for your rightful payout—even up to ombudsman or court if needed.

We remind you before expiry, suggest upgrades if your business grows, and stay with you for the long haul.

No more headaches, confusion, or feeling “alone” with insurance—ever.

FAQs: Your Questions, Our Straight Answers

What types of cargo can be insured under marine insurance with SMNICS?

Can I get coverage for both international and domestic shipments?

I’ve had claims rejected before—how does SMNICS help?

What documents are needed to buy marine insurance?

Do I need marine insurance for every shipment?

Does marine insurance cover losses due to delay or spoilage?

Can SMNICS help with claims if I bought my policy elsewhere?

Can factory owners insure machinery or capital goods in transit?

Is premium expensive for marine insurance?

How does claim settlement work for marine insurance?

Ready for Real Protection?

Don’t gamble with your shipment’s future. SMNICS is your cargo’s bodyguard.

Had a claim denied before? Worried about paperwork, fine print, or payout delays?

This is where SMNICS stands out—claims, advice, and full support, every step.

Book a free, no-obligation marine insurance review with SMNICS and Sharmaji now.

Contact Us Today:

- Phone: 88492 83897

- Email: nps@ahmedabadinsurance.com

- Office: Titanium City Centre Mall, Office No. 313, 100 Feet Road, Satellite, Ahmedabad – 15

No big talk, just honest advice. SMNICS protects your cargo, your business, and your peace of mind.